arizona solar tax credit 2019

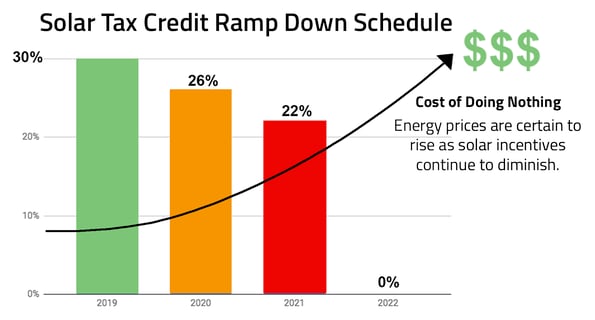

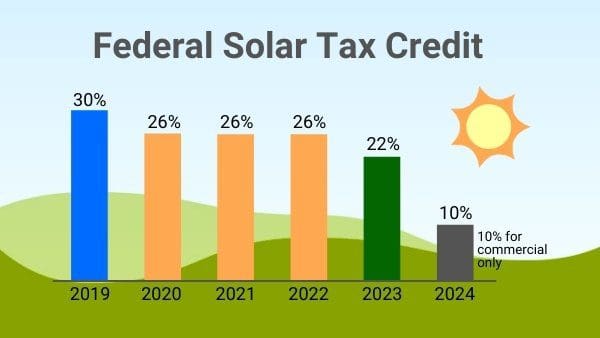

Installation of the PV system must have been between January 1 2006 and December 31 2019. Tax Credit Reduction Timeline.

Fortunately the Geothermal Tax Credit allows homeowners to apply their tax credit over multiple years.

. Dont forget about federal solar incentives. A nonrefundable individual tax credit for an individual who installs a solar energy device in taxpayers residence located in. AZ Form 310 for.

The federal solar tax credit gives you a dollar-for-dollar reduction against your federal income tax. This is claimed on Arizona Form 310 Credit for Solar Energy Devices. As a credit you take the amount directly off your tax payment rather than as a deduction from your taxable.

The Arizona Commerce Authority ACA administers the Qualified Small Business Capital Investment program. Each state has its own renewable energy incentive programs. Thanks to the Inflation Reduction Act the solar tax credit has been increased to 30 and extended for 10 years.

Arizona offers state solar tax credits -- 25 of the total system cost up to 1000. This means that in 2017 you can still get a major discounted price for your. Arizona law provides a solar energy credit for buying and installing a solar energy device at 25 25 of the cost including installation or 1000 whichever is less.

The 25 state solar tax. Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit. Arizona alone has dozens of financial incentives rebate and loan programs for both.

IRS Form 5695 for 2019. Every resident in Arizona who installs solar panels gets a state tax credit of 25 of the total system cost up to 1000 to be used toward State income taxes. June 6 2019 1029 AM.

Here are the specifics. A nonrefundable individual and corporate tax credit for installing one or more solar energy devices for commercial or industrial purposes in the taxpayers trade or business. Arizona solar tax credit.

Information Administration shows that the state accounted for nearly 45 of. The 30 federal solar tax credit will be in effect until 2033 and there is. To claim this credit you must also complete Arizona Form.

The federal solar tax credit. It is a 25 tax credit on product and installation for both 2020 through 2023. The 26 federal solar tax credit is available for purchased home solar systems installed by December 31 2022.

23 rows Did you install solar panels on your house. 1 Best answer. Arizonas Tax Incentives and Solar Rebate Programs.

In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was. The 30 tax credit applies as long as the home solar system is installed by December 31. Tax Incentives For Solar Conversion AZ Convert To Solar And Save Phone.

Arizona has the Arizona Solar Tax Credit. Income tax credits are equal to 30 or 35 of the investment amount. IRS Form 5695 for 2020.

Since 1995 the state of Arizona has offered. An individual or corporate income tax credit is available for taxpayers who own a qualified energy generator that first produces electricity before Jan. The tax credit remains at 30 percent of the cost of the system.

Solar Federal Tax Credit. Renewable Energy Production Tax Credit. With the investment tax credit ITC now referred to as the Residential Clean Energy Credit for residential systems you.

The Federal Geothermal Tax Credit Your Questions Answered

Arizona Solar Incentives Credits Rebates

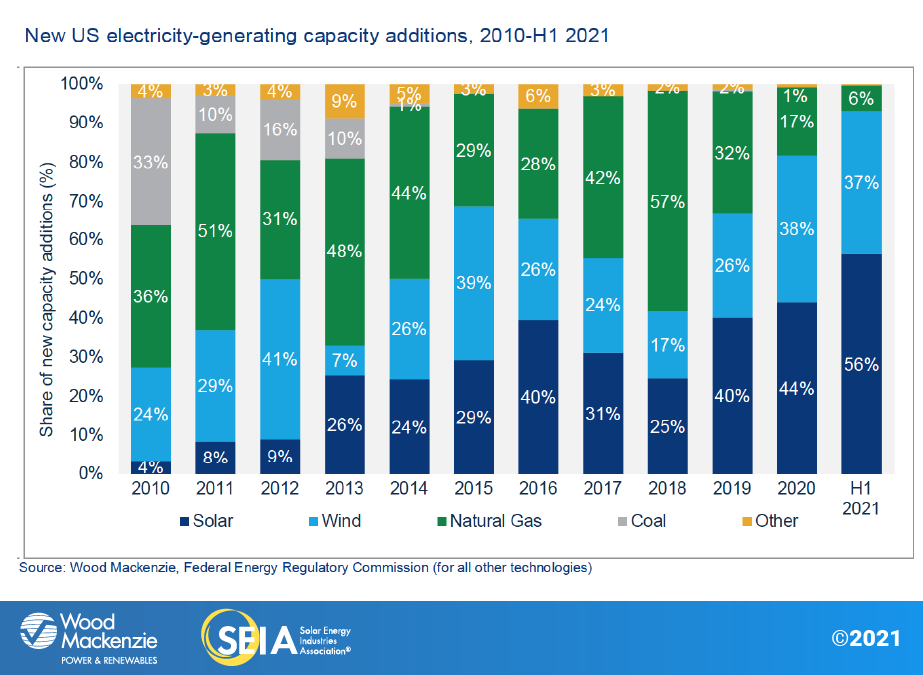

Solar Market Insight Report 2021 Q3 Seia

Guide To Arizona Incentives Tax Credits In 2022

The Federal Solar Tax Credit Extension Can We Win If We Lose Institute For Local Self Reliance

How The Solar Tax Credit Extension Will Affect New Solar Customers Through 2019

Arizona Solar Tax Credits And Utility Rebates 2020 Edition

Solar Investment Tax Credit 2020 Solar Tax Credit For Businesses

Renewable Energy Credit Market Archives Enerknol

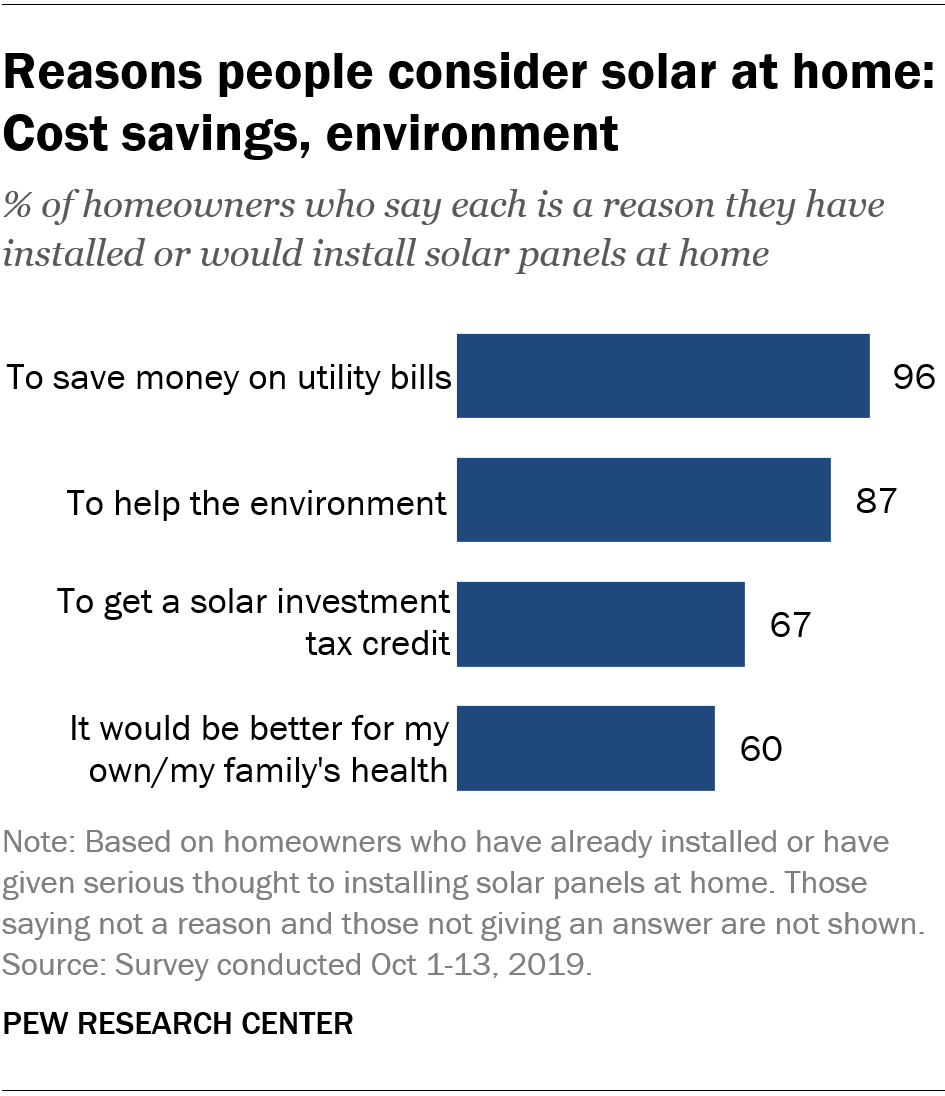

More U S Homeowners Say They Are Considering Home Solar Panels Pew Research Center

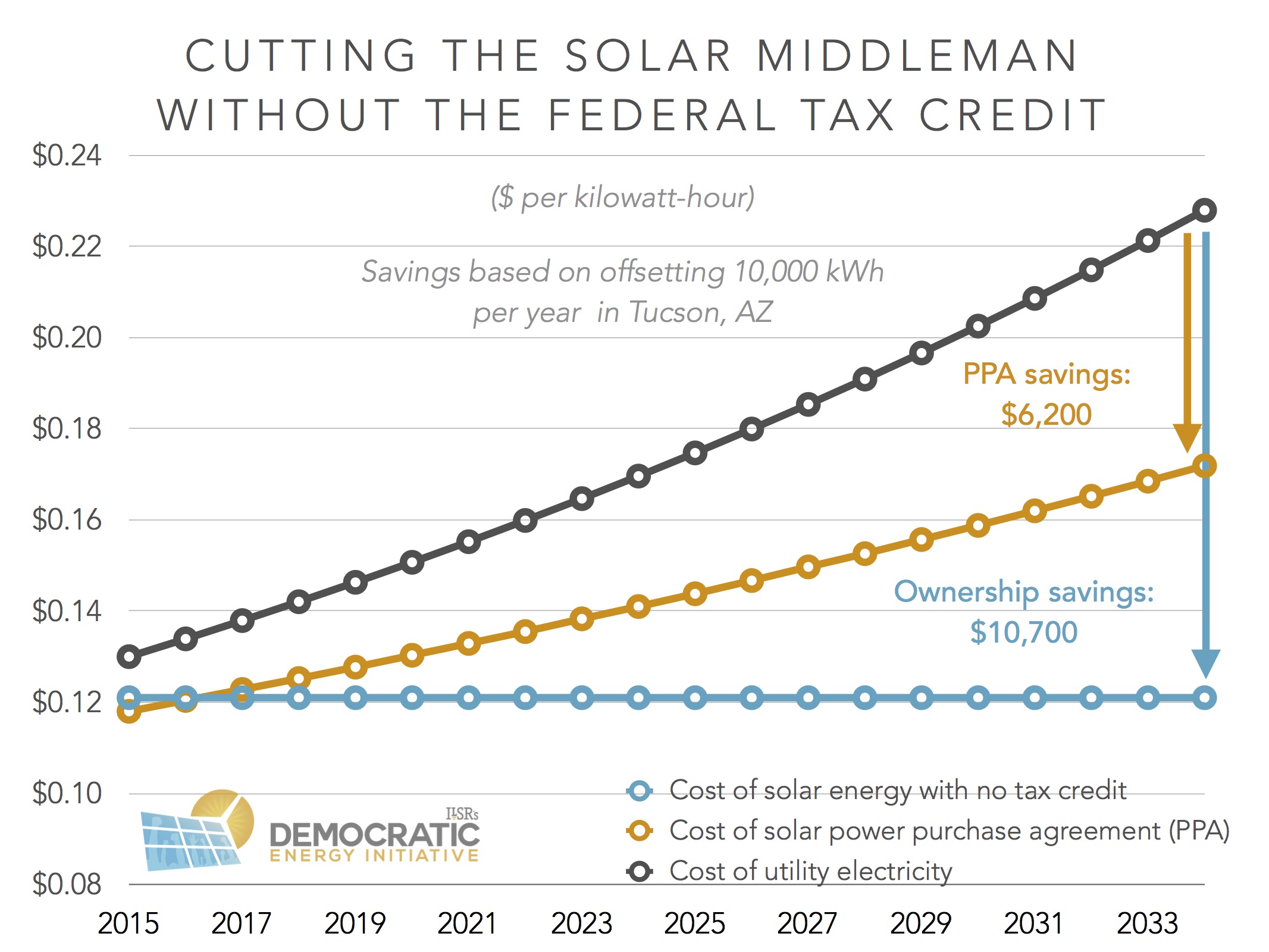

Compelling Reasons To Stop Procrastinating Regarding Solar

I Don T Have Solar Energy Installed And It S Asking For My Adresss In Arizona Form 310 I Went To Tax Tools And Delete Forms And It S Not Listed There

U S Energy Information Administration Eia Independent Statistics And Analysis

Federal Arizona Solar Tax Credits Incentives Pep Solar

Homeowner S Guide To The Federal Tax Credit For Solar Photovoltaics Department Of Energy

How Much Do Solar Panels Cost 2022

The Federal Solar Tax Credit Explained Revised 2021

I Am Not Claiming A Solar Credit But Keep Receiving An Error On My Az Form 310 Asking For The Address Of Where I Installed Solar Energy Device How Do I Get