modified business tax rate nevada

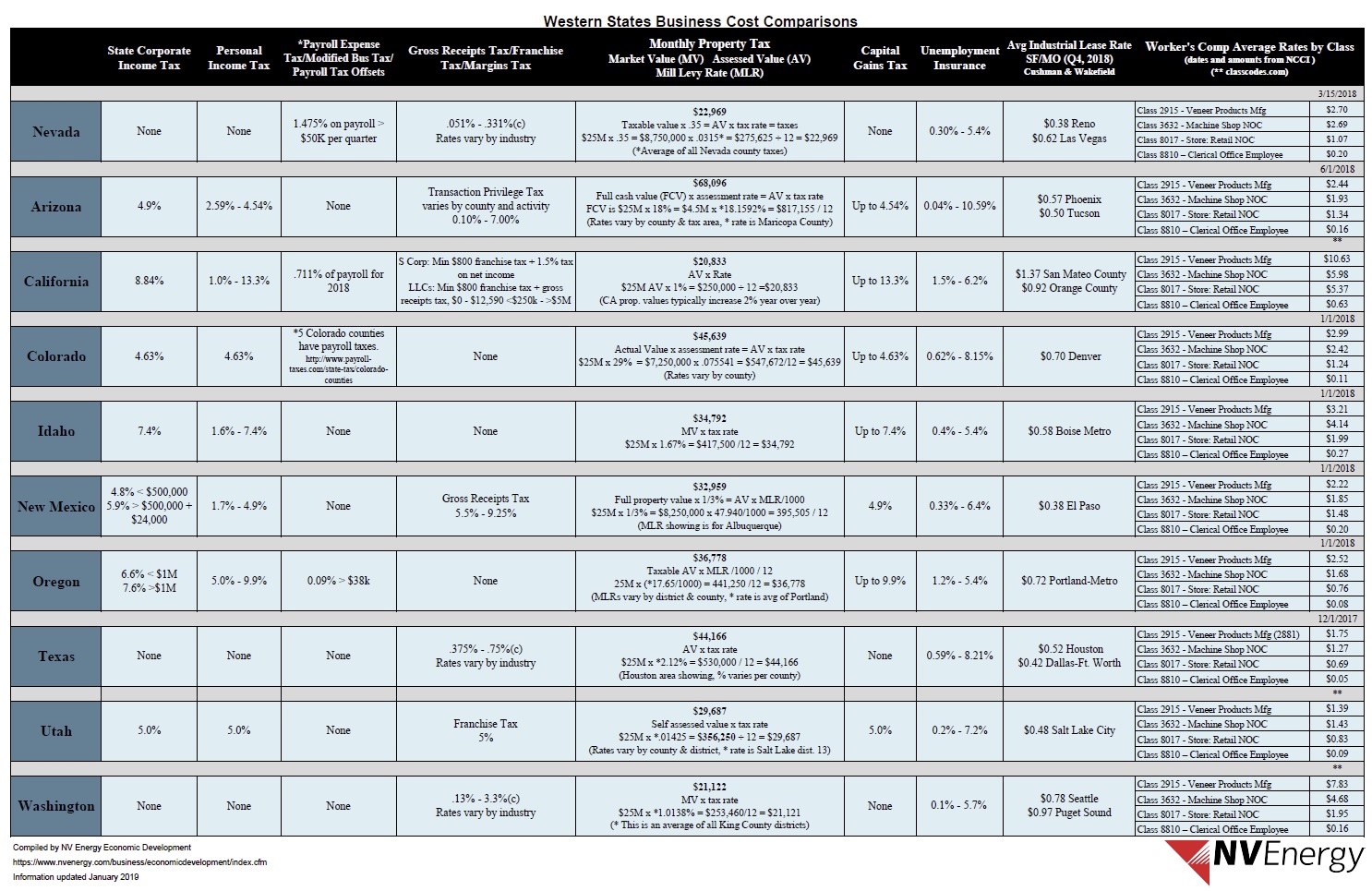

Nevada has a 685 percent sales tax rate and a max local rate of 153 percent with an average combined state and local sales tax rate of 823 percent. Fiscal Year 2020 Tax Rates Forecast Actual Difference Difference Tax Rates Modified Business Tax 1475 general business.

Business Friendly Nevada Northern Nevada Development Authority

Nevada levies a Modified Business Tax MBT on payroll wages.

. There is one general rate 1475 percent and a higher rate for financial institutions 20 percent. SB 483 of the 2015 Legislative Session became effective July 1 2015 and changes the tax rate to 1475 from 117. The Modified Business Tax MBT is currently imposed on businesses other than financial institutions in the amount of 117 percent of wages paid above an exemption level of 85000 per quarter.

31 2019 through March 31 2021 for general business financial institutions and mining. Does Quickbooks have to change it and give it with some sort of update. The MBT rate is 117 percent.

The modified business tax is described by the Nevada Department of Taxation as a quarterly payroll tax. However before the July 1 2019 effective date legislation was enacted to maintain the current rates. The Nevada Modified Business Tax rate has changed--it is now 001378 and not 01475.

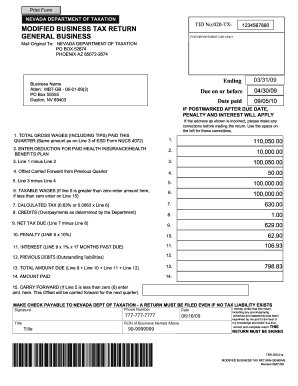

PdfFiller allows users to edit sign fill and share all type of documents online. To get started on the blank use the Fill camp. 101 000 - 50 000 51 000 x MBT Rate.

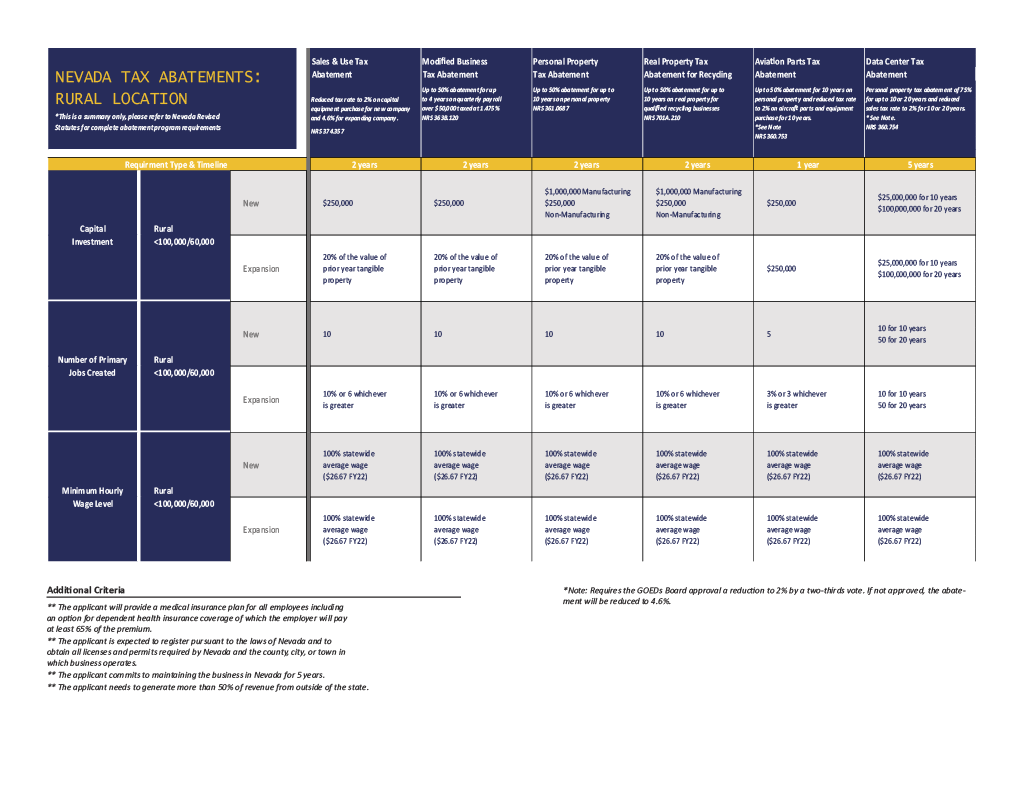

Nevada Revised Statute 363B120 provides an abatement of the Modified Business Tax for qualifying businesses. COMPARISON OF THE QUARTELRY AND ANNUAL TAX DUE UNDER THE MODIFIED BUSINESS TAX ON NON-FINANCIAL BUSINESSES FROM EXEMPION OF 62500 AND 85000 IN QUARTERLY TAXABLE WAGES AT THE 117 TAX RATE FOR SELECTED QUARTERLY TAXABLE WAGE AMOUNTS Prepared by the Fiscal Analysis Division February 10 2013 - 430 PM. The Department of Taxation confirmed it is developing a plan to reduce the Modified Business Tax rate for quarters ending Sept.

How you can complete the Nevada modified business tax return form on the web. Nevada levies a Modified Business Tax MBT on payroll wages. Since the passage of the Tax Cuts and Jobs Act in December of 2017 the corporate tax rate has been changed to a flat 21.

Modified business tax rate nevada. The MBT rates have remained the same 1475 on taxable wages exceeding 50000 annually for most businesses 2 for financial institutions and mining companies and were not reduced to 1378 and 1853 respectively. Ad Solutions to help your business manage the sales tax compliance journey.

Ad Download Or Email NV TID 020-TX More Fillable Forms Register and Subscribe Now. The payroll tax missed that mark by one vote passing 13-8 with all Republicans opposed. Extending the higher rate MBT was projected to raise 982 million over the biennium.

The MBT rate is 117 percent. Modified Business Tax Changes and Refunds On May 13 2021 the Nevada Supreme Court upheld a decision that the biennial Modified Business Tax rate adjustment was unconstitutional and ordered the Nevada Department of Taxation to refund any overpayment of the Modified Business Tax plus interest to businesses. The DOT has been ordered to refund to businesses the excess tax collected plus interest from the date of collection.

In a notice to taxpayers the department said it will soon announce when the refunds will be issued. For example if the sum of all wages for the 9 15 quarter is 101 000 after health care and qualified veteran wage deductions the tax is 752. However the first 50 000 of gross wages is not taxable.

Ad pdfFiller allows users to edit sign fill and share all type of documents online. In late 2018 the required threshold was exceeded and the MBT rates were scheduled to drop effective July 1 2019. In late 2018 the required threshold was exceeded and the MBT rates were supposed to decrease to 1378 percent and 1853 percent on July 1 2019.

That measure was projected to raise about 69 million a year. Sign Online button or tick the preview image of the blank. Creighton said any digital goods tax needs to be equitable because its about taxing a product digitally at the same rate whether you are buying a book in a local shop or digitally.

As we mentioned earlier there is no corporate income tax rate in Nevada. It is assessed if taxable wages exceed 62500 in a quarter. Learn how Avalara can help your business with sales tax compliance today.

The advanced tools of the editor will lead you through the editable PDF template. Financial institutions pay a higher rate of 2 percent. Additionally the new threshold is decreased from 85000 to 50000 per quarter.

How do I get a modified business tax number in Nevada. If the taxable wages are 62500 or less no MBT is due. A home business grossing 55000 a year pays 000 A small business earning 500000 a year pays 000 A corporation earning 10000000 a year pays 000 12 - Nevada Nonprofit Tax Exemptions Certain nonprofit entities registered in Nevada may be able to exempt some or all of their qualifying income from Nevada and federal income taxes.

In 2015 legislation was enacted to reduce both MBT rates if general tax revenues exceeded a certain threshold. I file this online but I want to change the tax rate on Quickbooks desktop so the guide form in Quickbooks is correct. The previous tax was set at 117 above an exemption level of 85000 per quarter although certain industries such as financial institutions paid a higher rate.

The new Modified Business Tax rates for FY20 as calculated pursuant to NRS 360203 are 1378for general business and 1853 for mining and financial institutions. Modified Business Tax has two classifications. I cannot figure out how to change this rate.

The new law imposes a 1475 MBT after July 1 2015 and lowers the exemption to 50000 per quarter. Enter your official contact and identification details. But remember your business is still liable for federal taxes.

The same thing happened to the bill to extend the 1 DMV technology fee on all DMV transactions. This is the standard quarterly return for reporting the Modified Business Tax for General Businesses. The previous tax was set at 117 above an exemption level of 85000.

Chapter 2 The Business Tax And Financial Environments

Does Qb Offer The Nv Modified Business Tax Payroll Form

2014 2022 Form Mt Ui 5 Fill Online Printable Fillable Blank Pdffiller

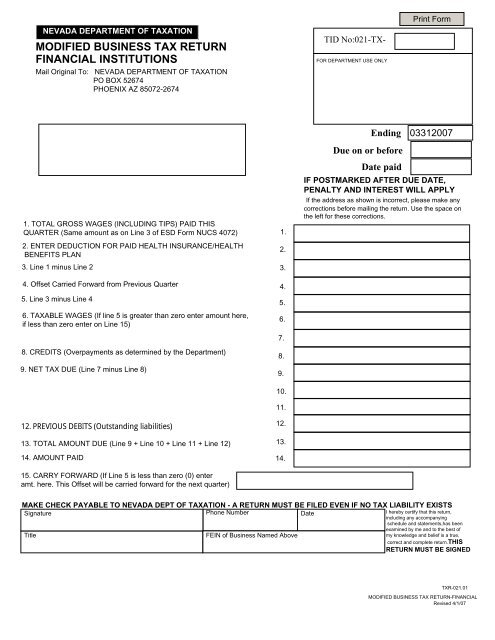

Modified Business Tax Return Financial Institutions

Modified Business Tax Return Financial Institutions

Modified Business Tax Return Financial Institutions

What Is The Business Tax Rate In Nevada

What Corporate Taxes Do Businesses Pay In Nevada Llb Cpa

Modified Business Tax Return Financial Institutions